What is the Regulation on Deforestation-Free Products (EUDR), and how will it impact brands?

By Ricky Alfred, Director of Responsible Business

UPDATE: The EU Commission is proposing to postpone the implementation of the EUDR, suggesting a 12-month delay. The proposal still needs signoff from both the European Parliament and member states but it would allow for parties to properly prepare for the landmark law.

Brands doing business in the EU must comply with a new regulation—the EU Deforestation Regulation. Introduced in June 2023, the regulation aims to limit the EU market’s impact on global deforestation, forest degradation, and biodiversity loss by promoting deforestation-free supply chains.

The objective: to limit deforestation, reduce the EU’s contribution to greenhouse gas emissions and protect human rights and the rights of indigenous people.

The new regulation affects everyone in the EU involved in commercialising seven commodities and their derivatives or embedded products. These are:

So think chocolate, furniture, leather, soya milk, burgers, books and tyres (to name a few). From a point-of-sale perspective, this will include things like cardboard, wooden frames, posters and wraps.

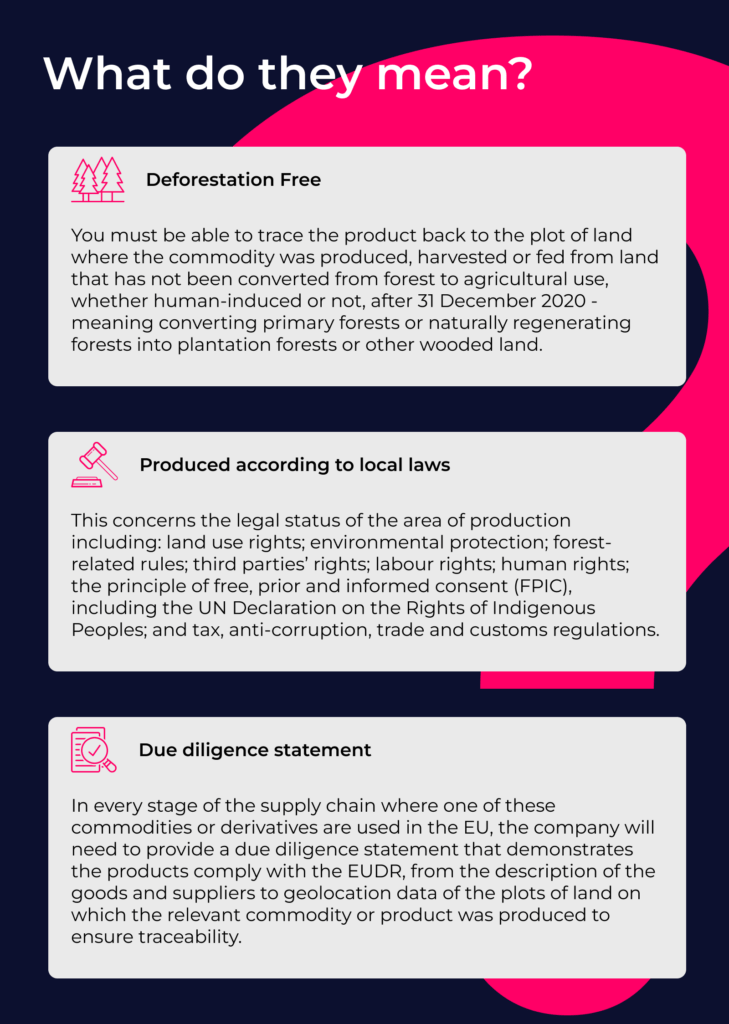

This means that these commodities and their derivatives are effectively prohibited from being imported, sold, or exported within the EU unless they are deforestation-free, produced in accordance with relevant local laws in their country of production, and covered by a due diligence statement.

Let us take a look at an example

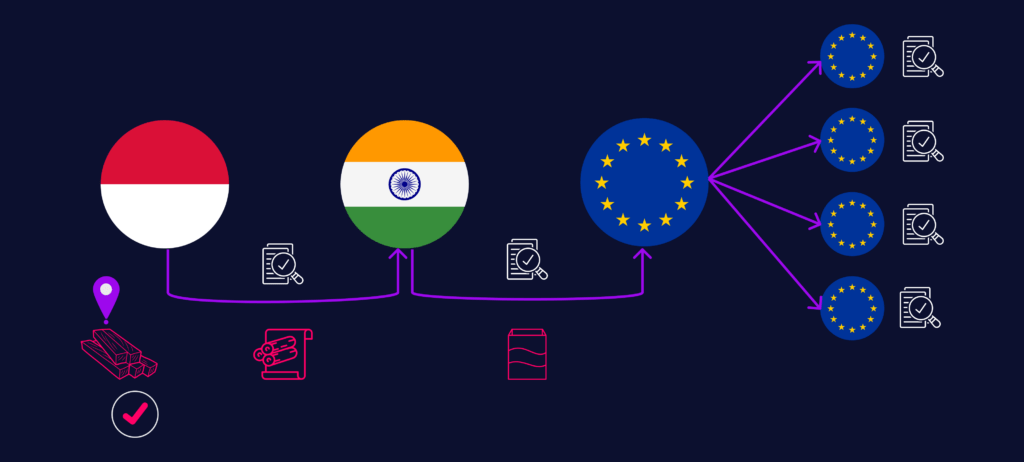

EU Company A is looking to import packaging materials from India to display products uniquely in retail stores across Europe. Their supplier in India receives its pulp and paper from its partner in Indonesia. The EU company is required to submit a due diligence statement guaranteeing its sourced products are deforestation free – so the packaging materials, pulp, paper and wood used to create the packaging.

This means supplying the geolocation for the plot of land where the materials originated from, with detailed documentation to prove the wood is deforestation free.

Furthermore, when placing the product in retail stores, each retailer must demonstrate that the product did not contribute to deforestation too and submit their own due diligence statement and retain legal responsibility if upstream companies breach the requirements set out by the EUDR. They can refer to the due diligence performed by predecessors by including the relevant reference number for the parts of their relevant products that were already subject to due diligence.

What if a part of the goods is discovered to be non-compliant?

The non-compliant goods must be physically separated from the compliant and only the compliant portion can be imported. If separation can not be achieved, the entire bulk is considered non-compliant and cannot be imported.

These rules also apply to goods produced in the EU, whether manufactured or sourced, when it comes to being exported. Companies must include a due diligence statement in their export declaration.

What are the implications for non-compliance?

Enforcement and penalties are still being discussed, but penalties may include:

- Fines proportionate to the environmental damage and value of the items, with a maximum of at least 4% of EU turnover.

- Confiscation of the covered products or of the revenues gained from the items.

- Temporary exclusion from public procurement processes and public funding.

- Temporary prohibition from dealing in the EU in those items or prohibition from using the simplified due diligence process.

Given that the regulation covers the entire value chain for products imported, produced, or exported from the EU, companies must prepare for the potential challenges and opportunities. Ensuring a transparent, traceable, and risk-free supply chain is not just a regulatory requirement, but also an opportunity to demonstrate commitment to sustainability and gain a competitive edge in the market.

With the buck stopping at the end of the value chain, regarding legal responsibility, it is down to each member of the supply chain to ensure the origination of materials adheres to EUDR.

Our hot take

While the regulation’s intention is sound, and we completely support efforts to ensure the sustainable production and procurement of materials, it has been met with considerable concern. Mainly from the developing world, where the intense compliance requirements will necessitate a significant investment from some of the poorest farmers.

However, the developing world is not the only one that has concerns. The two largest economies, the US and China, have rejected the legislation, which will make the traceability of commodities in those countries much more difficult.

As such, we see several challenges arising for global brands with the mandatory issuance of the Due Diligence Statements.

Price & Availability

In some countries, sustainable options are more expensive than conventional ones, due to the level of investment required to adhere to the regulations. Additionally, many producers and farmers must invest in new technologies and processes to ensure they are compliant for their partners.

Of course, this will impact the price of raw materials, with the expectation that they could increase quite significantly. The added cost of compliance will not just be added to the current costs; the increased demand from EU companies for compliant materials will only drive prices up as supply catches up.

The opportunity: For brands and their suppliers, this means exploring affordable alternatives, such as mycelium-based (mushroom) packaging or recycled materials. This could help support the growth of new sustainable materials and strengthen investment in these markets to improve availability and help support demand.

With many producers not being able to flick a switch to comply with this regulation overnight, they will need support from their global partners. Brands can look to support their suppliers by devising strategies to help partners make their operations viable in expensive markets. Whether that is supporting investment in local economies and areas where they might not be able to afford to become compliant or support and education to empower producers to implement complaint processes, strengthening your relationship with key elements of your supply chain.

A sharper focus on supply chains

With increased regulation, particularly regarding environmental targets and initiatives, companies’ supply chains will increasingly be scrutinized—not only in terms of due diligence for EUDR and reporting on Scope 3 emissions under the GHG Protocol, but also in response to other pressures concerning supply chain accountability.

However, our supply chains are driving these initiatives from the top down. Governments and regulations from the more developed world are asking less advanced economies to support these shifts at a rate that requires a significant investment in technology, skills, and resources.

This puts increased pressure on already-stressed farmers and producers, whose margins and financial sustainability are increasingly challenged. Some may be acting sustainably but just cannot afford the cost or do not have the technology to be compliant. Others may not be sustainable because their hands are forced by macroeconomic conditions.

So, while we need greater transparency and better reporting, we also need to factor in that we need to take everyone on the journey.

The opportunity: Making compliance a pre-competitive issue.

That means having clear guidelines for local teams that drive sustainability, innovation, and efficiency. We should also offer more support to our suppliers in adhering to those regulations. And we should collaborate, not just as buyers and suppliers but also as whole industries, to collectively achieve a more transparent, sustainable future.

How will this be enforced?

The final challenge we see is actually enforcing this regulation. We are still waiting for guidelines on the reporting requirements as well as the technology needed to support compliance.

Farmers across several of the commodities are calling on the EU to delay the regulation until they receive the appropriate guidance and FAQs to support producers in adhering to the regulation.

Additionally, for those who use the Forest Stewardship Council (FSC) certification, the FSC Trace (based on blockchain technology) — a key platform to help certificate holders with due diligence—is still in beta-testing with a small pilot group, and little information is available on when it will come to market.

This will make it hard for companies to comply with the regulation, particularly at the source. It means it is more important than ever for global brands to engage their supply chain partners and create opportunities to educate and prepare them for what is to come, developing stronger relationships with their suppliers in the process.

Final thoughts

There is still a lot to work through. News about the regulation appears almost daily, but the new regulation is coming in, even if there are proposals to postpone its implementation for 12 months.

This extra time is crucial for us all. It allows us to thoroughly assess our supply chains, invest further in sustainable alternatives, and continue to collaborate with suppliers to develop compliant processes. It’s also an opportunity to explore innovative solutions in even greater depth and strengthen relationships with key partners in our supply chain.

The trend towards stricter environmental regulations is necessary and clear, and we are all working to adapt. Now is the time to press ahead with our plans, knowing that this additional year will enable us to be even more prepared.

Over the coming months, we will continue to update you on what is coming and provide helpful insight on how you can best navigate the new regulation so that you can continue to produce WOW-factor point-of-sale campaigns.

More to come…but for now, you can read more about how we measure our carbon footprint here.